2023 payroll tax withholding calculator

Use this tool to. Subtract 12900 for Married otherwise.

State Corporate Income Tax Rates And Brackets Tax Foundation

It is mainly intended for residents of the US.

. Prepare and e-File your. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Then look at your last. The Tax withheld for individuals calculator is.

Unemployment insurance FUTA 6 of an. Subtract 12900 for Married otherwise. Get Started With ADP Payroll.

Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise. 250 minus 200 50. It will be updated with 2023 tax year data as soon the data.

This calculator is for 2022 Tax Returns due in 2023. The payroll tax rate reverted to 545 on 1 July 2022. The amount of income tax your employer withholds from your regular pay.

The Tax withheld for individuals calculator is. Subtract 12900 for Married otherwise. Free Unbiased Reviews Top Picks.

Thats where our paycheck calculator comes in. Start the TAXstimator Then select your IRS Tax Return Filing. Prepare and e-File your.

For employees withholding is the amount of federal income tax withheld from your paycheck. All Services Backed by Tax Guarantee. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. There are 3 withholding calculators you can use depending on your situation. The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Choose the right calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Prepare and e-File your. Tax withheld for individuals calculator. See how your refund take-home pay or tax due are affected by withholding amount.

There is also a special payroll tax rate for businesses in bushfire affected local. Ad Compare This Years Top 5 Free Payroll Software. This calculator honours the ATO tax withholding formulas.

This calculator is integrated with a W-4 Form Tax withholding. That result is the tax withholding amount. Then look at your last paychecks tax withholding amount eg.

2022 Federal income tax withholding calculation. Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul Free Unbiased Reviews. Federal withholding calculator 2023 per paycheck.

2022 Federal income tax withholding calculation. 2022 Federal income tax. Use Before 2020 if.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. 250 and subtract the refund adjust amount from that. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time.

That result is the tax withholding amount. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise.

Paycheck after federal tax. Ad Payroll So Easy You Can Set It Up Run It Yourself. 2022 Federal income tax withholding calculation.

2022 Federal income tax withholding calculation. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Ad Process Payroll Faster Easier With ADP Payroll.

Get Started With ADP Payroll. 2022-2023 Online Payroll Tax Deduction Calculator. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data.

IRS Form W-4 is. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Calculate your state local and federal taxes with our free.

Accordingly the withholding tax. Prepare and e-File your. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. 250 minus 200 50. This Tax Calculator will be updated during 2022 and 2023 as new 2023.

The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Process Payroll Faster Easier With ADP Payroll.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Prepare and e-File your. Withhold 62 of each employees taxable wages until they earn gross pay.

Estimate your federal income tax withholding. Get Started With ADP Payroll.

10 Tax Tips For A Smooth Client Tax Season

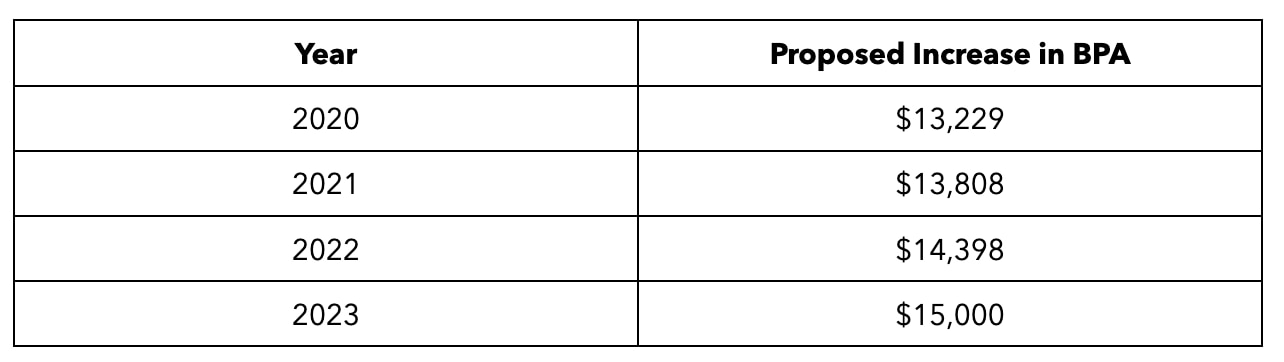

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Social Security What Is The Wage Base For 2023 Gobankingrates

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Salary Slab Rates Budget 2022 2023 Latest Updates Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2022 2023 Tax Brackets Rates For Each Income Level

Estimated Income Tax Payments For 2022 And 2023 Pay Online

New 2022 Tamil Calendar 2023 Apk In 2022 Tamil Calendar Calendar App Calendar

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Payroll Updates For Nz New Tax Year 2022 2023 Keypay